Citi sees sustained economic growth and investment opportunities despite global market volatility

|

Citi Philippines consumer banking head Manoj Varma (2nd from right) joined speakers who shared their expertise with Citigold clients at the 2018 Mid-Year Market Outlook (L-R): Kelvin Lam of Allianz Global Investors, Anis Tiasiri of J.P. Morgan Asset Management, Julian Tarrobago of ATR Asset Management Inc., and Ramon Tejero of Citicorp Financial Services and Insurance Brokerage Philippines Inc.

Citi, the country’s leading foreign bank, remains positive about economic growth in the Philippines despite current global market volatility. At a series of mid-year outlook events, Citigold clients heard expert views on the current market environment and implications for investment strategy shared by Citi and guest speakers.

Citi’s consumer banking head Manoj Varma opened the sessions and explained the importance of understanding risks and opportunities when investing. Varma said, “Citigold clients look for trusted advice and up-to-date information, especially during times of market volatility.”

According to Ramon Tejero, Citicorp Financial Services and Insurance Brokerage Inc. (CFSI) investment product head, market data shows that we are in the midst of the second longest and third strongest equity bull market since 1970. Recent market volatility has been primarily caused by rising interest rates, potential trade wars, and geo-political tensions.

“Despite market concerns, there appears to be opportunities in technology, financials, healthcare, and industrials due to continued earnings growth in these sectors,” said Tejero.

|

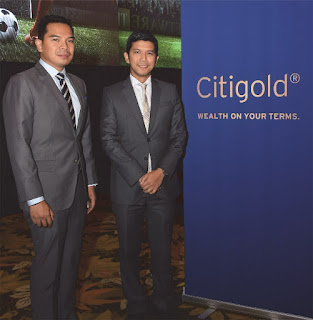

Citi Philippines Retail Bank head Rene Aguirre (right) welcomes clients to the 2018 Mid-Year Outlook along with Citigroup Financial Services and Insurance Brokerage Philippines president Lester Cruz.

In the Philippines, Citi believes the country’s economic growth momentum will be sustained in the coming years. Citi forecasts GDP will grow by 6.8% in 2018 and 6.7% in 2019. A primary source of growth will be the government’s infrastructure program.

However, businesses and consumers are showing cautious optimism on the back of ongoing inflation concerns. Citi expects inflation to top 5.3% in the third quarter of 2018 before declining to below 5.0% in the following quarter.

“Investors can focus on diversification across asset classes and geographies and income themes, while watching out for tactical opportunities,” concluded Tejero.

“The world is indeed shrinking and when, where, and how we invest is largely influenced not only by domestic factors but also by global market events,” said Rene Aguirre, Citi Retail Bank head. “As trusted advisors, we help our clients grow and protect their wealth. In recent months, 10 new investment products have been launched and digital innovations continue to be developed, such as the recently unveiled next generation Citi mobile app.”

For more information, visit www.citibank.com.ph.